Orange Côte D'Ivoire: 13% ROI in 6 Months!

4 min Read October 5, 2023 at 2:21 PM UTC

In 2022, the State of Côte d’Ivoire wants to divest their stake in the Orange Côte d’Ivoire (OCI) and sell their shares, equivalent to 9.95%, on the Regional Stock Exchange (BRVM). Through the transaction, the seller wants to contribute to the development of the BRVM stock market, guarantee transparency of the disposal operation and increase awareness of the Company through an IPO.

By selling part of its stake in OCI’s capital, the Government of Côte d’Ivoire aimed to achieve the following goals:

- Promote popular shareholding and thus diversify the capital;

- Contribute to the development of the BRVM sub-regional stock market;

- Maximize the revenues of the Government of Côte d’Ivoire;

- Ensure the transparency of the Transaction;

- Increase OCI’s notoriety among the financial community and the general public

The Company had at the time 3 large shareholders with 74% of the OCI Group is still owned by Orange France.

Business Model

Orange offers a variety of telecommunication services in the area of fixed, mobile, internet, million customers across three countries and the different services.

The company started with mobile phone products that consumers needed on a daily basis and could be sold easily and then established itself by acquiring parts in the local landline company, CI Telecom. According to industry experts, this allowed Orange CI to have a quick turnover, which allowed them to cut costs on using the telecom network and offer better services.

- The company, in Côte d’Ivoire and other countries, directly or in contribution, for own account or on behalf of third parties, intervenes in:

- The study, realization, maintenance, exploitation or management of any system, equipment or service within the Telecommunications and the Information and Communication Technologies (ICT) sector, as well as in any other fields involving this sector.

- The acquisition or exploitation of any right, concession, license, or privilege necessary for the pursuit of the above purposes.

- The merger by any means, with any telecommunications or other company.

The acquisition of interests or participation, by any means, of any existing company or any enterprise to be created, which may be related to the above object. - Any commercial, industrial, security, property, or financial transaction involving the above object.

These activities are primarily spread across the subsidiaries below, located in Côte d’Ivoire, Burkina Faso and Liberia.

These activities are primarily spread across the subsidiaries below, located in Côte d’Ivoire, Burkina Faso and Liberia.

ORANGE CI PERFORMANCES 2022

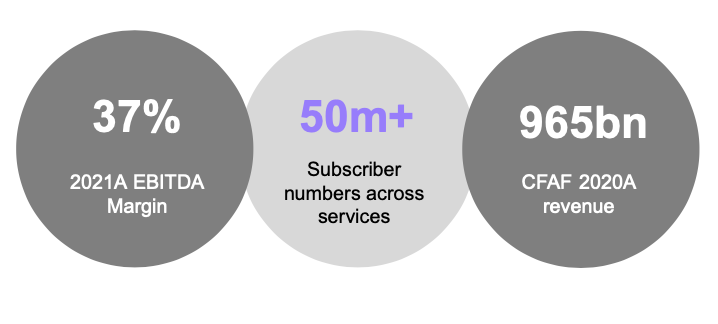

KPI 2021

OCI Performances

By year end 2022, Orange Côte d’Ivoire Group had achieved good operating margin growth and outstanding sales performance in a difficult macroeconomic and competitive environment.

The Orange Côte d’Ivoire Group, leader in each of its three countries of presence (Côte d’Ivoire, Burkina Faso and Liberia), achieved good financial and operating performance in 2022 despite a difficult socio-economic, security, inflationary and competitive context, demonstrating the resilience of its activities and good cost control.

This financial performance is the result of a remarkable operational performance in 2022, which saw very sustained growth in the subscriber bases, particularly 4G, Orange Money and Fixed Broadband, made possible by the recruitment of new customers, the development of usage on product lines and the investments made in extending our mobile and fixed networks.

Consolidated sales for the 3 countries amounted to 965 billion FCFA, in line with the 2021 target. Mobile data and fixed-line broadband offset the slowing effects of (i) competition on mobile money, generating a significant loss of value (down 32.1% due to the tariff overhaul in Côte d’Ivoire and Burkina Faso) and (ii) incoming national traffic (down 24.3%) due to the drop in call termination from 5F to 3F in Côte d’Ivoire.

These performances were made possible by the 158.5 billion FCFA of investments made by all subsidiaries, representing 16.4% of consolidated sales (up +2.9pt). Mainly driven by projects to extend and densify the mobile network, but also to deploy fiber, these investments have enabled us to improve quality of service and 3G and 4G coverage throughout our territories.

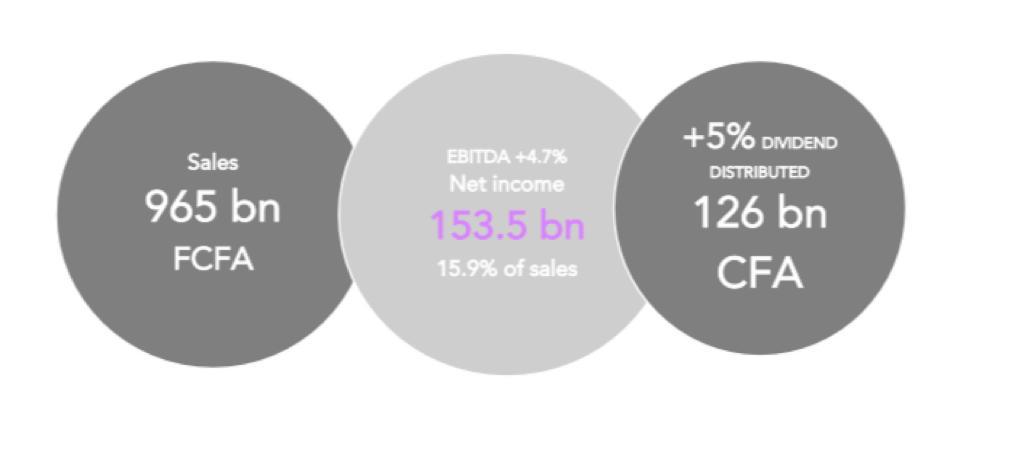

KPI 2022

OCI’s consolidated net income for 2022 reached 153.5 billion FCFA, representing 15.9% of sales, was down -1.5%, due to the combined effect of higher operating income and corporate income tax expenses in fiscal 2022 reflecting a gross dividend of 126 billion FCFA representing an increase of 5%. Consequently, the gross dividend per share will be 836.4 FCFA, representing a net dividend per share of 752.76 FCFA.

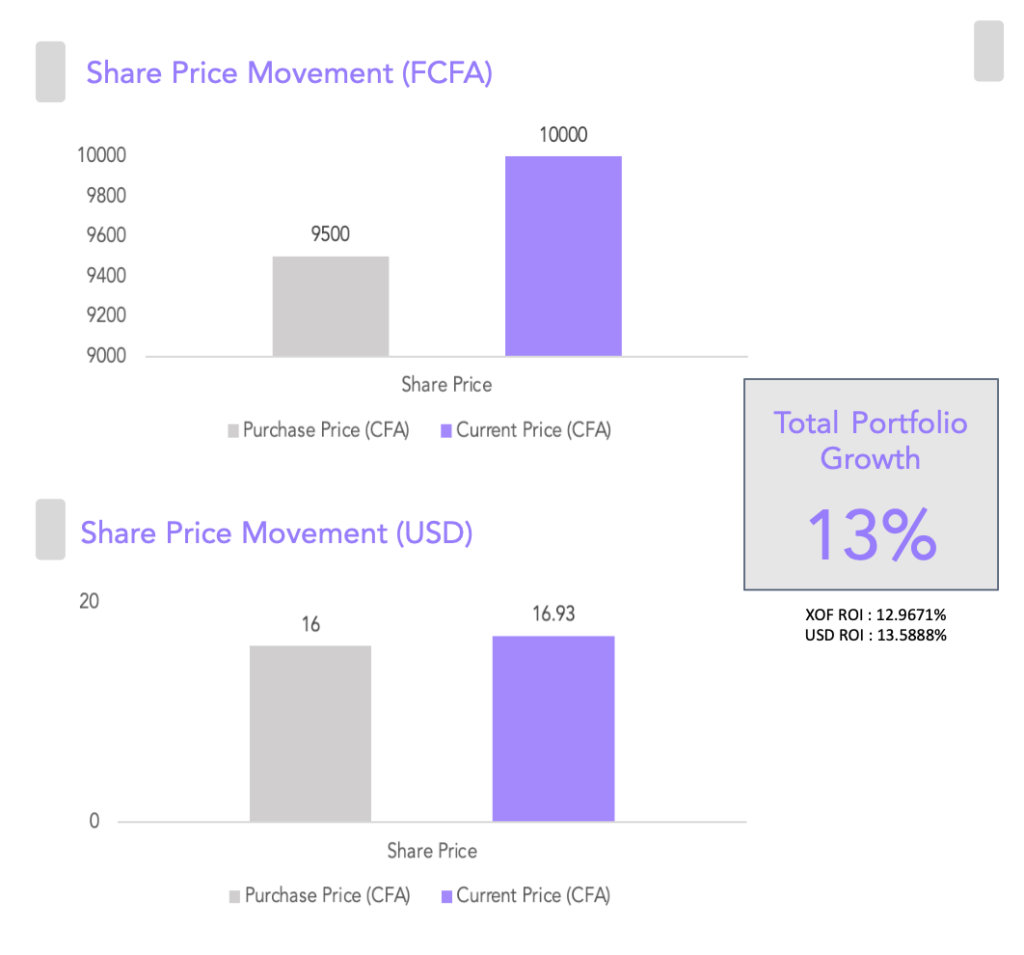

daba-finance-invest-africa-orange-share-price

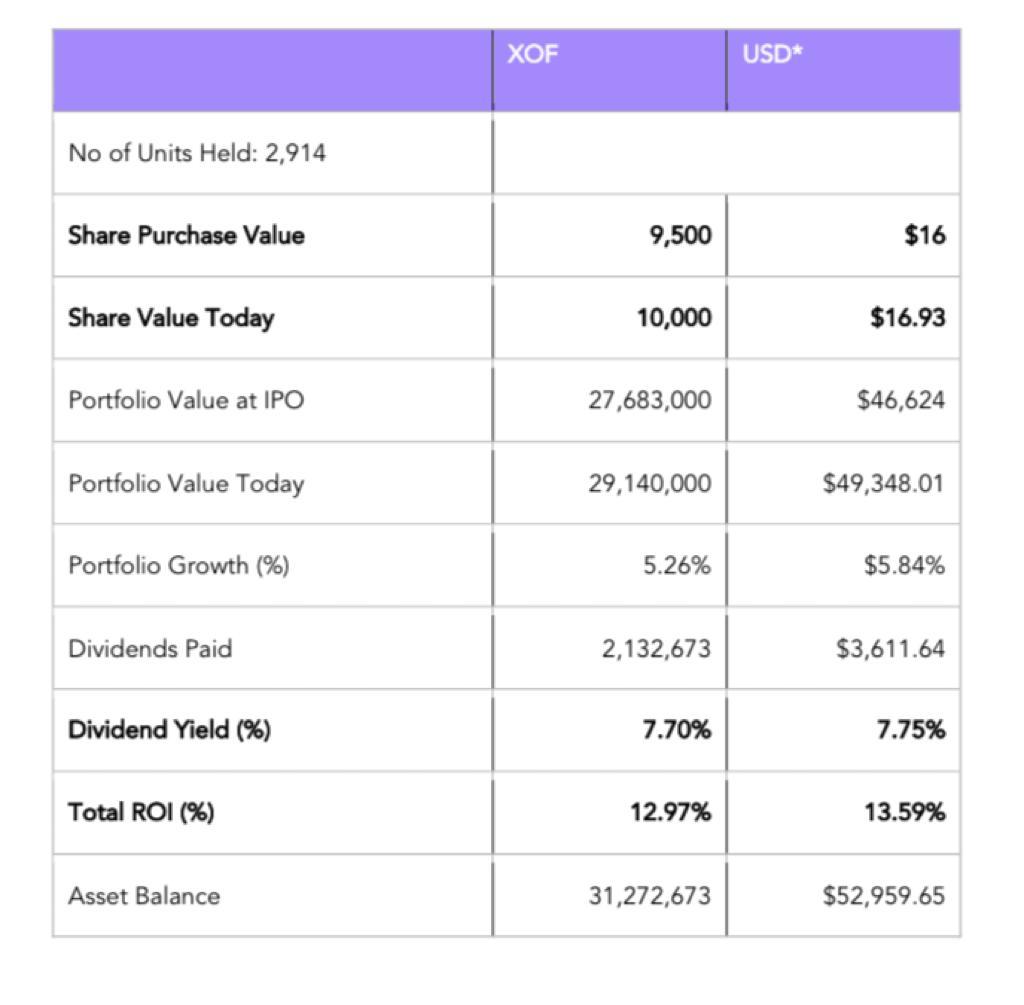

Example of returns for a Daba Investor on July 31st 2023

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.