African Countries With Highest GDP Per Capita in 2024

4 min Read September 25, 2024 at 11:12 PM UTC

Gross Domestic Product (GDP) per capita is a commonly used indicator to compare the economic prosperity of countries.

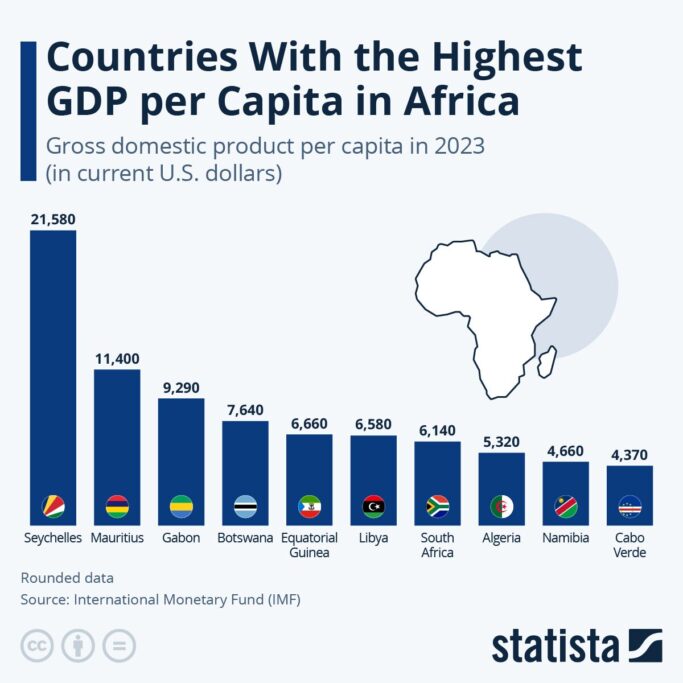

In Africa, the International Monetary Fund (IMF) recently ranked countries by their GDP per capita for 2023, providing insights into how economies on the continent are performing.

The ranking also signals both prosperity and structural reliance on various sectors.

Below, we briefly highlight the countries with the highest GDP per capita and provide a brief overview of their economies.

1. Seychelles – $21,580

Seychelles holds the top spot with a GDP per capita of $21,580. This island nation thrives on tourism, making it the most prosperous in Africa. However, its heavy dependence on the global tourism sector makes it vulnerable to disruptions like the 2008 recession and the COVID-19 pandemic, where its economy contracted significantly.

2. Mauritius – $11,400

Mauritius follows closely with a GDP per capita of $11,400. Known for its stability and diversified economy, Mauritius has developed strong sectors in tourism, textiles, and financial services, which continue to bolster its prosperity.

3. Gabon – $9,290

Gabon, with a GDP per capita of $9,290, primarily benefits from oil exports. While oil is a major driver, Gabon has been focusing on diversifying its economy, particularly in agriculture and forestry, to reduce its dependence on volatile oil prices.

4. Botswana – $7,640

Botswana stands strong at $7,640 per capita, largely due to its diamond mining industry. The country’s prudent fiscal policies and good governance have transformed it into one of Africa’s more stable economies, with a focus on education and health improvements for long-term growth.

5. Equatorial Guinea – $6,660

Equatorial Guinea, at $6,660 GDP per capita, is another oil-rich nation. Its wealth has not trickled down evenly, and the country faces significant challenges in terms of income inequality and the need to invest in social development.

6. Libya – $6,580

Libya ranks sixth with a GDP per capita of $6,580, relying heavily on oil production. The country, however, continues to face political instability, which hampers its ability to fully capitalize on its natural resources.

7. South Africa – $6,140

South Africa has a GDP per capita of $6,140. Its economy is the most industrialized in Africa, supported by diverse sectors like mining, manufacturing, and services. However, South Africa also struggles with high levels of inequality and unemployment, limiting its economic potential.

8. Algeria – $5,320

Algeria, with a GDP per capita of $5,320, is one of the largest oil producers in Africa. Like other oil-dependent countries, its economy fluctuates with the global price of oil, and the government has been pushing to diversify into other sectors, including agriculture and renewable energy.

9. Namibia – $4,660

Namibia has a GDP per capita of $4,660, driven by its mining industry, especially diamonds and uranium. Although relatively small, Namibia’s population benefits from the country’s political stability and natural resource wealth.

10. Cabo Verde – $4,370

Rounding off the top ten is Cabo Verde, with a GDP per capita of $4,370. Its economy is heavily reliant on tourism and remittances from the diaspora. Despite being a small island nation, it has made significant strides in economic development, though it remains vulnerable to external shocks.

While GDP per capita provides a useful metric to measure national wealth, it does not account for internal disparities.

Several of these countries, particularly oil-dependent ones like Gabon, Libya, and Equatorial Guinea, experience significant inequality, with wealth concentrated in the hands of a few.

Metrics like the Gini index are important to consider when analyzing the true economic well-being of a country’s population.

Thus, this snapshot of Africa’s top-performing countries by GDP per capita underscores the continent’s wealth potential and the underlying challenges of diversification and inequality.

Rising GDP Per Capita: A Boon for Foreign Investors

As Africa’s GDP per capita rises, the continent’s economy is becoming more attractive to foreign investors. However, this growth has not always been evenly distributed, often leaving vast opportunities untapped.

If better distribution of wealth can be achieved, it creates a fertile ground for investors to gain substantial returns by supporting companies addressing the growing needs of the African middle class – especially in key sectors like telecoms and fast-moving consumer goods (FMCG).

As disposable incomes rise, so does consumer demand for essential services like mobile communications and everyday consumer products. Foreign investors who recognize this shift can profit by backing companies within these industries, especially those that innovate and adapt to local markets.

By using platforms like the Daba app, foreign investors can easily access companies like Sonatel (SNTS) and Orange (ORAC), many of which are already making a mark in Africa’s high-growth economies.

Our platform offers investors an opportunity to back firms in these sectors, allowing them to tap into Africa’s rising consumer base while supporting the continent’s long-term economic transformation.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.