May Markets Pulse | Stocks Outshine Market in Spectacular Surge

6 min Read June 3, 2025 at 1:32 PM UTC

West African equities surge as tobacco, packaging, and beverage companies deliver returns amid earnings momentum and sector rotation.

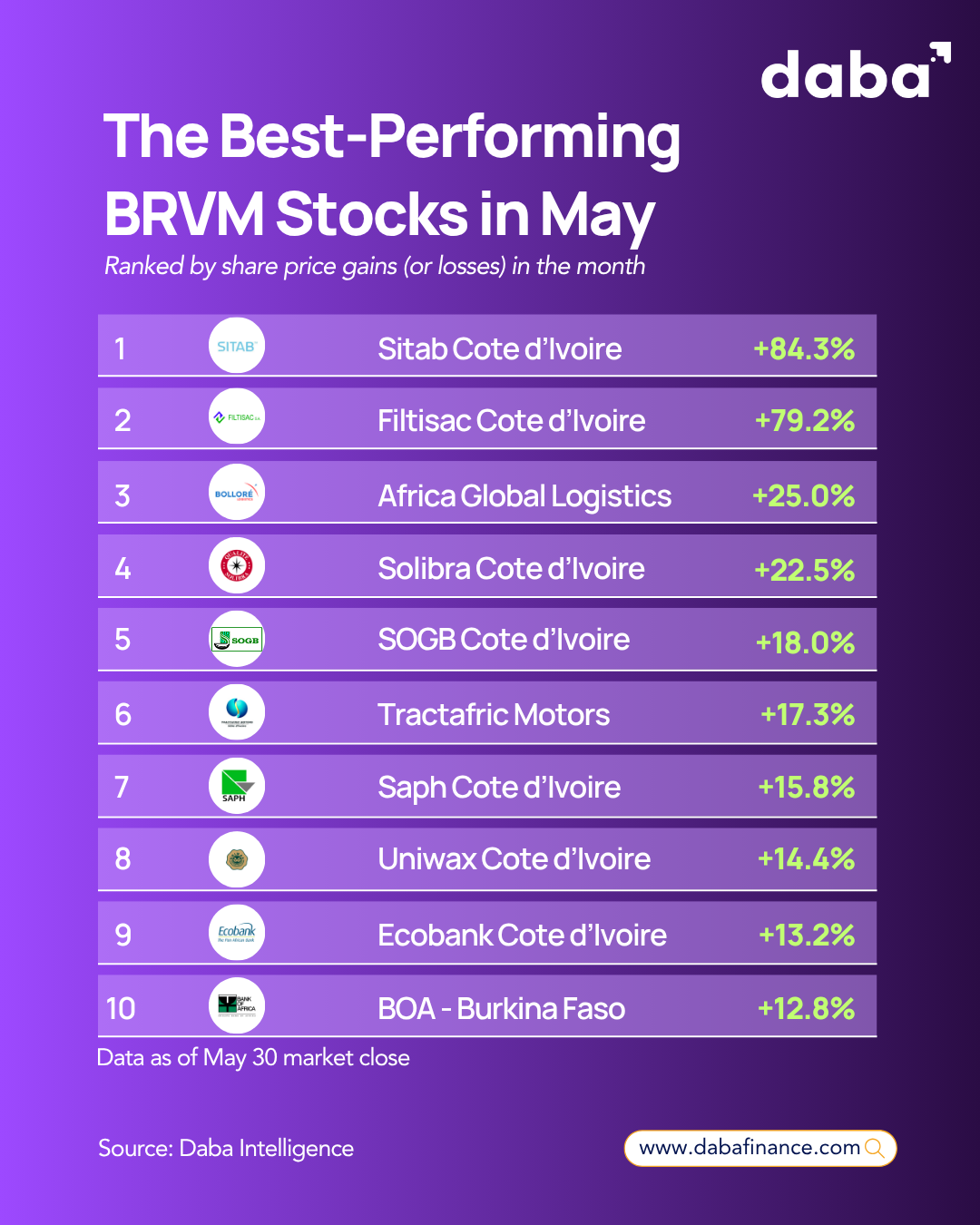

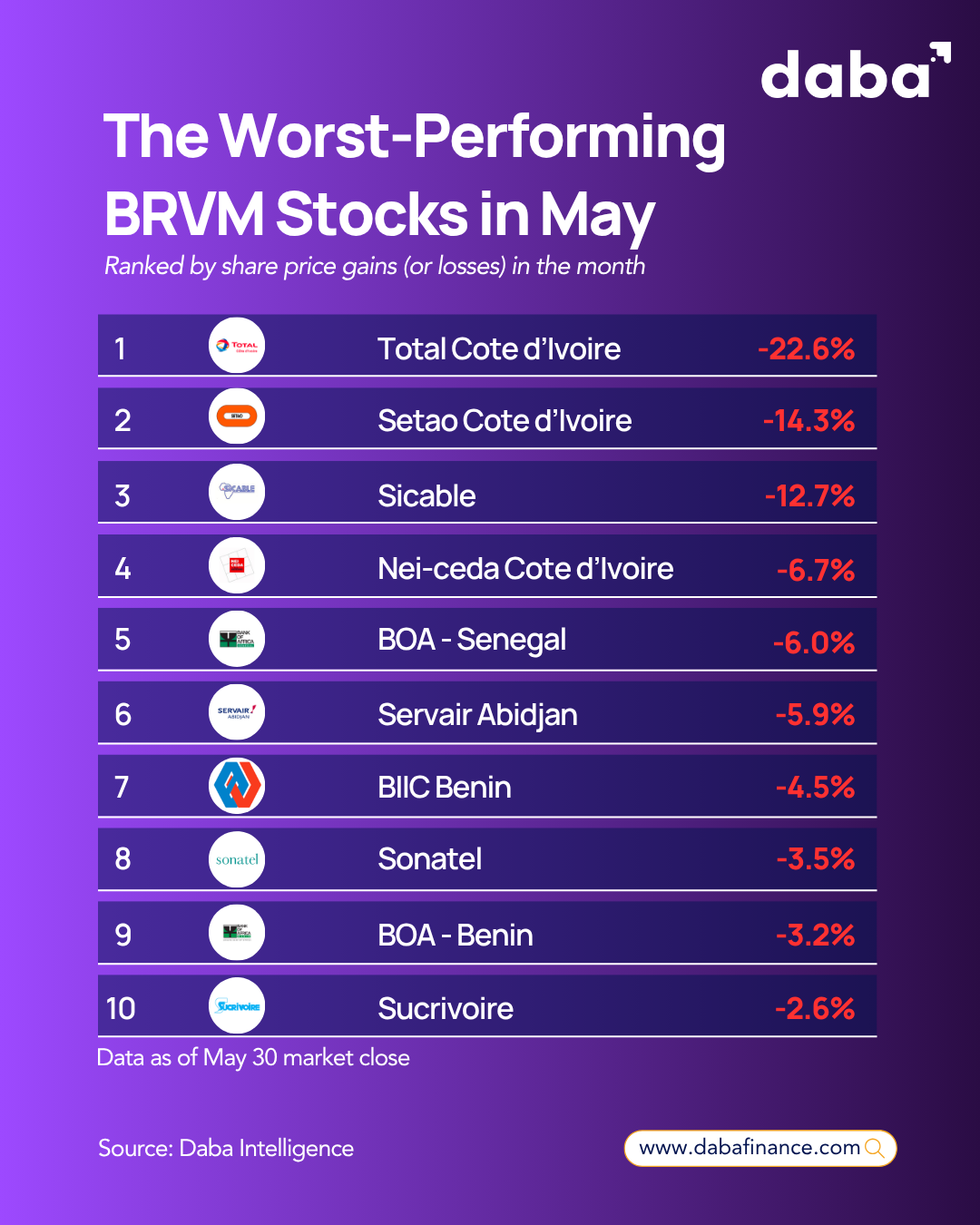

The BRVM composite index on May 15 reached its highest level since July 2016, climbing to 300.38 points and marking a milestone as the equity market’s capitalization reached 11.6 trillion FCFA ($19.8 billion). The benchmark posted a 4.7% gain for May 2025, with standout stocks delivering returns that outpaced this performance.

Société Ivoirienne des Tabacs (SITAB) posted an 84.3% surge during the month, followed by packaging company Filtisac at 79.2% and Africa Global Logistics at 25.0%, showing the market’s interest in companies with growth stories.

The performance of these West African equities reflects investor confidence returning to the region’s stock markets, driven by corporate earnings, commodity prices, and a rotation from fixed income to equity assets.

Tobacco Company Leads Gains

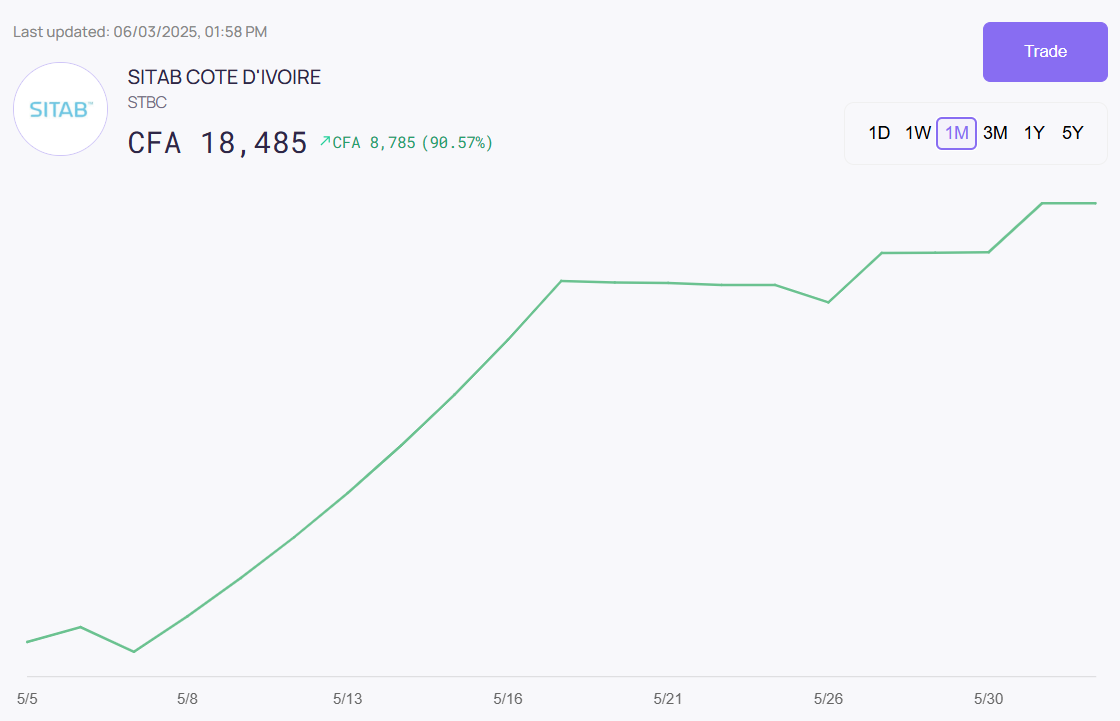

SITAB’s 84.3% rise during May represents one of the month performances in BRVM history. The Ivorian tobacco manufacturer’s share price showed upward movement throughout the month, building on Q1 2025 results that saw net income rise 146% to 9.41 billion CFA francs despite a 7% decline in sales volume.

The company’s ability to navigate regulation through pricing demonstrates operational management. Following the implementation of minimum price requirements and excise tax increases, SITAB offset volume declines with 45% price increases, showing pricing power in the Ivorian market. This pricing flexibility, combined with the company’s position in a market where tobacco consumption patterns differ from developed economies, has positioned SITAB as a performer in the consumer staples sector.

The tobacco manufacturer’s 2024 results show its financial strength, with net income rising to 44.73 billion CFA francs on revenue growth of 26% to 216.13 billion CFA francs. The company’s cash position of 48.16 billion CFA francs provides flexibility for growth initiatives and shareholder returns.

Packaging Company Benefits from Agriculture

Filtisac’s 79.2% gain during May reflects the market’s recognition of the packaging company’s performance despite agriculture sector challenges. The Ivorian packaging company, which serves agriculture exporters including cocoa producers, showed adaptability in navigating sector conditions while maintaining dividend distributions.

The company’s announcement of a 28.2 billion FCFA distribution to shareholders, representing a dividend yield of 41.57% at the time announced, signals management’s confidence in cash flow generation. This distribution comprises dividends and merger premium payments, highlighting the company’s positioning and capital allocation.

While Filtisac faced Q1 2025 challenges with an operating loss of 78 million FCFA compared to a profit in the year, the company’s diversification into polymer packaging provides protection from the agriculture sector volatility. The packaging sector’s exposure to Côte d’Ivoire’s cocoa industry, which represents 40% of global supply, creates opportunities and challenges as weather and crop diseases impact demand patterns.

Beverage Company Maintains Position

Solibra’s 22.5% gain during May reinforced its position as West Africa’s beverage company, building on 2024 results that saw net profit climb 42% to 21.5 billion CFA francs. The company’s position in Ivory Coast’s beverage market, with brands including Coca-Cola products and sodas, positions it to benefit from urbanization and middle-class consumption.

The beverage manufacturer’s efficiency improvements were visible in its cost management initiatives, with raw material purchases falling to 74.7 billion CFA francs from 81.2 billion CFA francs, helping boost margins. Operating profit jumped to 34.7 billion CFA francs from 16.8 billion CFA francs, showing the company’s ability to navigate price pressures while maintaining market share.

Solibra’s product portfolio and distribution channels provide advantages as economic growth drives demand for packaged beverages across the region. The company’s balance between positioning and affordability for price-conscious consumers has enabled market leadership in Ivory Coast’s economy.

Logistics Company Capitalizes on Regional Trade

Africa Global Logistics achieved a 25.0% gain during May, reflecting the growing importance of logistics infrastructure in West Africa’s expanding economy. The logistics company benefits from increased trade flows across the region and the growing need for efficient supply chain solutions as economies develop and urbanization accelerates.

The logistics sector in West Africa faces opportunities from regional integration initiatives and infrastructure development projects. Companies providing transportation, warehousing, and distribution services are positioned to benefit from cross-border trade growth and the expansion of regional value chains.

Africa Global Logistics’ performance during May suggests investor recognition of the company’s role in facilitating regional commerce. The logistics sector’s growth potential aligns with broader economic development trends across West Africa, where improving infrastructure and trade facilitation create demand for logistics services.

Agriculture Commodities Drive SOGB Performance

Société des Caoutchoucs de Grand-Béréby’s 18.0% gain during May reflects conditions in rubber markets and the company’s business model spanning rubber and palm oil production. SOGB’s Q1 2025 performance, with net profit rising 263% to 6.02 billion FCFA, shows the effect of commodity price increases on profitability.

The rubber and palm oil producer benefits from its positioning in Côte d’Ivoire, where it operates plantations and processing facilities. Revenue jumped 63% in Q1 2025, driven by selling prices and sales volumes, while the palm oil business contributed diversification with 37.7% revenue growth.

SOGB’s role in Ivory Coast’s agriculture economy extends beyond financial performance, with payments to village planters highlighting the company’s integration with farming communities. As Africa’s rubber producer and the fourth producer, Ivory Coast’s rubber sector employs 160,000 people, with SOGB playing a role in this ecosystem.

Market Dynamics and Sector Rotation

The performance of these performers reflects market dynamics favoring companies with operational fundamentals and exposure to commodity cycles. The performance gap between performers and the benchmark index suggests stock picking based on analysis rather than appreciation. This approach by investors indicates a market where company factors drive performance rather than sector momentum.

For investors seeking to benefit from West African equity opportunities, Daba provides access to private and public markets across the continent. The Daba Academy offers market education for understanding regional investment dynamics, while Daba Pro delivers research and stock recommendations for investors.

The May performance of BRVM’s stocks shows the market’s potential for delivering returns when analysis identifies companies with operational execution and market positioning. As West African economies continue expanding and market infrastructure develops, equity investment in companies promises opportunities for outperformance.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.