How African Diaspora Investment Clubs Are Building Wealth With Daba

5 min Read August 4, 2025 at 11:45 AM UTC

Across Europe, North America, and beyond, a new wave of financially savvy Africans in the diaspora is rewriting the playbook on how to invest in the continent.

At the center of this movement is a simple, powerful concept: the investment club—and a digital platform that makes it all possible: Daba.

A Growing Movement of Diaspora-Led Investment Clubs

For decades, Africans abroad have contributed to the continent primarily through remittances. In 2024, diaspora remittances to Africa totaled over $95 billion, with Nigeria, Egypt, and Morocco leading as top recipients.

This inflow was roughly equivalent to the total foreign direct investment (FDI) into the continent for the same period.

Remittances have consistently been a significant and reliable source of external finance for African economies, often exceeding FDI, portfolio flows, and official development assistance.

But a new generation is going further—pooling knowledge, capital, and ambition to co-invest in African stocks, bonds, and real economy opportunities.

These diaspora-led investment clubs are emerging in cities like Montreal, London, Paris, and Atlanta—often formed by students, professionals, or entrepreneurs looking to build wealth and make a difference back home.

What’s changed? The barriers to entry that once kept African markets out of reach are being broken down by technology. And one of the platforms leading this shift is Daba.

Why Investment Clubs Are Choosing Daba

Daba is an all-in-one investment platform built for Africa. It enables individuals—and collectives like investment clubs—to access curated African assets across public markets and real economy sectors, all from a mobile-first experience. Here’s how diaspora clubs are using Daba to turn ambition into action:

1. Frictionless Market Access

Most diaspora investors struggle with fragmented regulations, minimum capital requirements, or a lack of trusted brokers in African markets. Daba solves this by offering a fully digital platform that connects users directly to opportunities in countries like Côte d’Ivoire, Senegal, and beyond—without requiring incorporation or a local bank account.

2. Collective Investment Made Simple

Investment clubs can pool capital, track returns, and co-manage their portfolios easily. Whether it’s through a shared Daba account or coordinated individual actions with group strategy, members can invest together without the usual legal and logistical headaches.

3. Powerful Research and Insights

Many diaspora-led clubs want to move beyond sentiment and into data-driven investing. With Daba Pro, users access stock research, curated investment ideas, and macroeconomic reports on African markets—equipping clubs to make smarter, more confident decisions.

4. Financial Education on Demand

Through Daba Academy, club members—regardless of their background—can learn the fundamentals of investing in Africa. Courses range from how the BRVM stock exchange works to how to evaluate bonds and real estate projects. This democratizes access to knowledge that was once only available to insiders or finance professionals.

From Concept to Action: The Diaspora Is No Longer Waiting

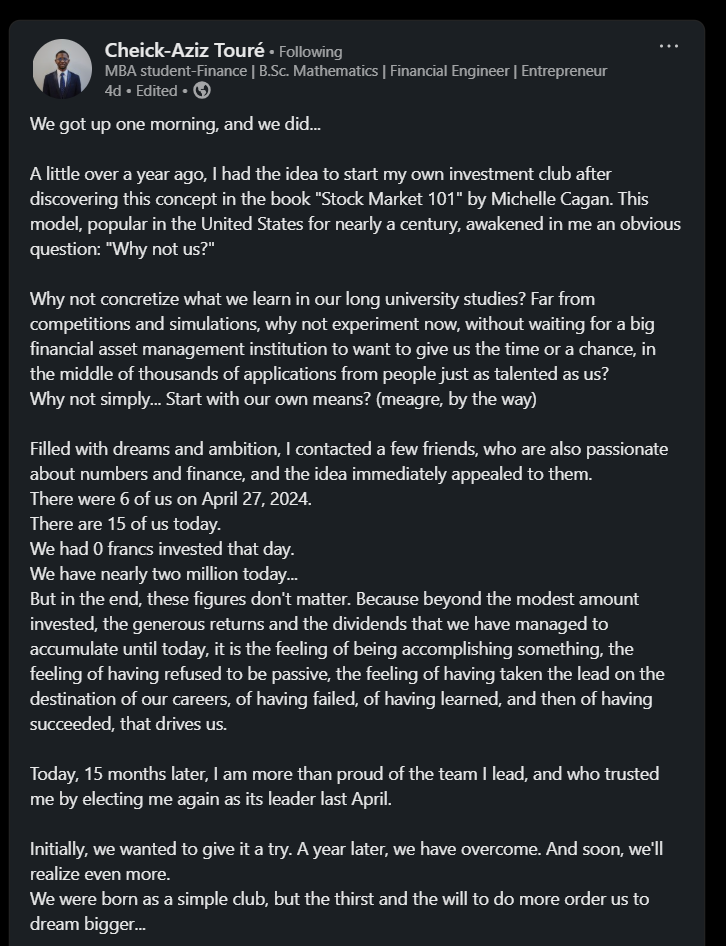

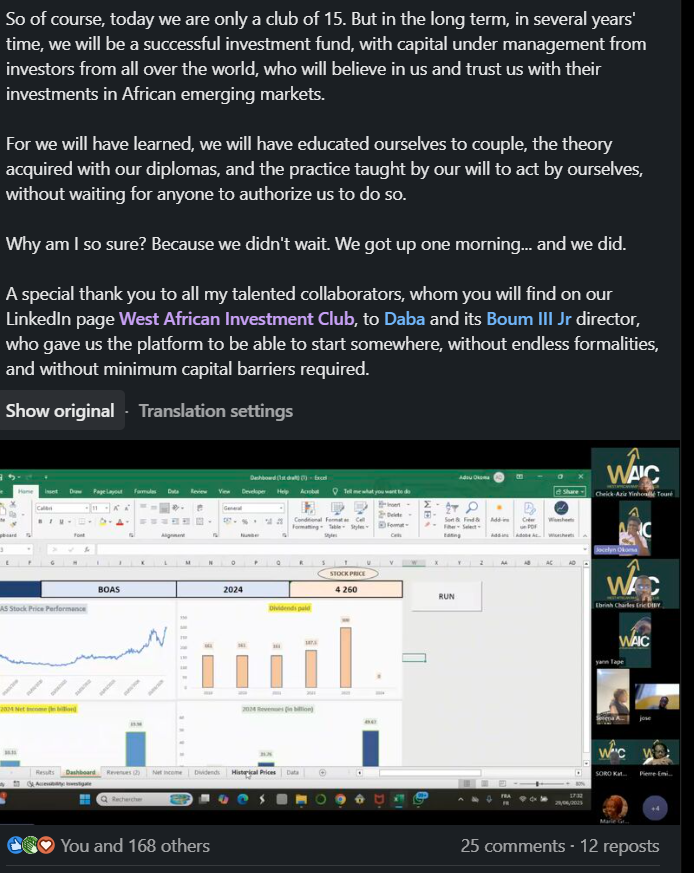

Take the example of Cheick-Aziz Touré, an Ivorian MBA student in Quebec who co-founded the West African Investment Club with a few fellow students. Inspired to act, they used Daba to start investing in African stocks with zero capital at first—and now manage a growing portfolio.

We didn’t wait for authorization. We didn’t need a financial institution to approve us, says Cheick-Aziz. “[Daba] gave us the platform to be able to start somewhere, without endless formalities, and without minimum capital barriers required.”

This story is no longer the exception. Dozens of clubs—comprising doctors, engineers, graduate students, consultants, and young entrepreneurs—are replicating the model. Whether they’re investing in agriculture bonds in Senegal or stock opportunities on the BRVM, they are using Daba as their launchpad.

A Pathway to Bigger Impact

For many clubs, the long-term vision is to evolve into fully-fledged investment funds. And with a platform like Daba, that path becomes clearer. By combining:

- Shared capital

- Continuous learning through Daba Academy

- Market intelligence via Daba Pro

- And seamless investing on the Daba app

…diaspora clubs are not only growing wealth—they are building financial infrastructure that serves African futures.

You Don’t Need Millions to Start

One of the most empowering features of Daba is its low barrier to entry. Many clubs start small—$100 per member, per month—and grow organically. This accessibility has opened the door for thousands of young Africans abroad to stop waiting and start acting.

They’re not just sending money home. They’re building equity, developing skills, and investing in Africa’s long-term prosperity.

Ready to Build with Your Network?

Here’s how to start your own diaspora-led investment club with Daba:

- Create a group chat with trusted peers

- Agree on shared goals and capital contributions

- Download the Daba app and start exploring investments

- Use Daba Pro to choose smart opportunities

- Learn with Daba Academy to sharpen your strategy

- Track your progress—and reinvest your gains

You don’t need a finance degree or a million-dollar fund to participate in Africa’s growth story. You just need a community, a plan, and the right tools.

The future of African investing is collective, digital, and powered by the diaspora. And it’s already happening—with Daba.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.