African Economic Outlook 2024: Resilience and Opportunities for Investors

6 min Read June 27, 2024 at 6:12 PM UTC

Get key insights from the African Economic Outlook 2024 report and explore investment opportunities in the continent’s fastest-growing regions.

The African Economic Outlook 2024, published by the African Development Bank, presents a comprehensive analysis of Africa’s economic performance and future projections.

The report highlights the continent’s resilience in the face of multiple global shocks and outlines strategies for driving structural transformation and sustainable growth.

In the following, we provide an overview of key insights from the report and explore investment opportunities in Africa’s fastest-growing regions.

Key Highlights

Economic Resilience and Growth Projections

Despite facing high food and energy prices, geopolitical tensions, climate change impacts, and political instability, African economies have shown remarkable resilience.

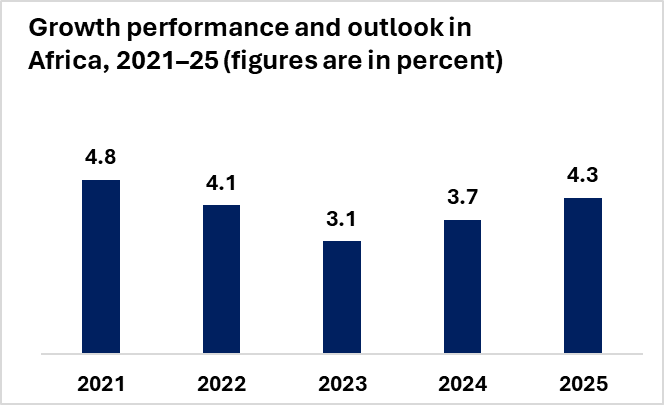

Africa’s average real GDP growth slowed to 3.1% in 2023 from 4.1% in 2022 but is projected to rebound to 3.7% in 2024 and 4.3% in 2025.

This rebound underscores the continent’s capacity to recover and grow despite significant challenges.

Sectoral Performance

Growth in Africa is driven by increased public investments in key sectors and substantial capital outlays on critical public infrastructure.

Non-resource-intensive economies are projected to see higher growth due to diversified economic activities, highlighting the importance of investing in various sectors to sustain economic growth.

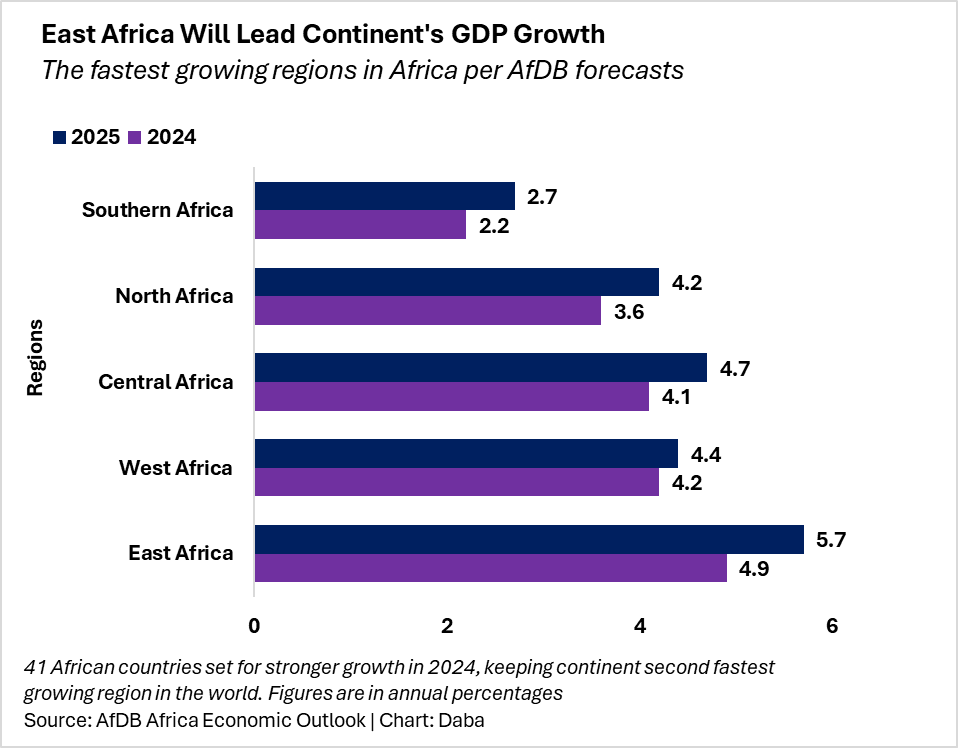

Fastest Growing Regions in Africa

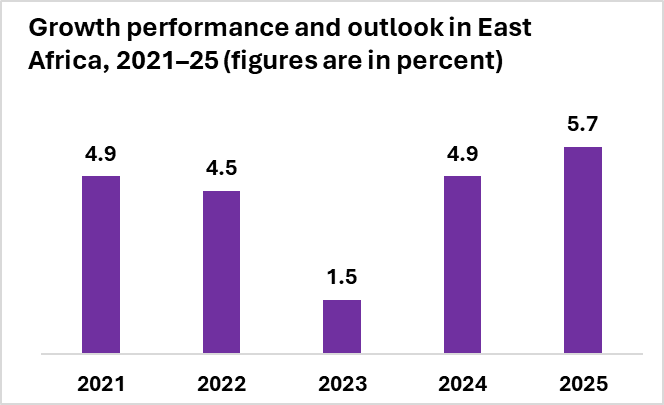

East Africa: Leading the Growth

Growth Projections:

- Expected to be the fastest-growing region, with GDP growth projected to rise from 1.5% in 2023 to 4.9% in 2024 and 5.7% in 2025.

Investment Opportunities:

- East Africa’s rapid growth is driven by increased investments in infrastructure, technology, and services.

- Investors can explore opportunities in the Nairobi Securities Exchange (NSE) and the Dar es Salaam Stock Exchange (DSE) for exposure to promising sectors such as technology, telecommunications, and financial services.

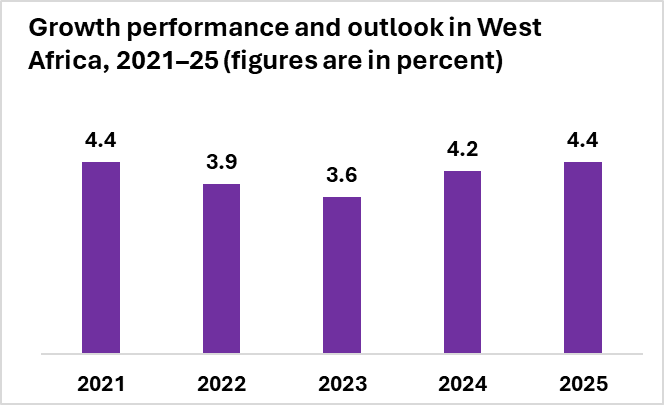

West Africa: A Region of Promise

Growth Projections:

- Projected growth to pick up from 3.6% in 2023 to 4.2% in 2024 and 4.4% in 2025.

Investment Opportunities:

- West Africa’s growth is bolstered by strong performance in major economies like Côte d’Ivoire, Ghana, Nigeria, and Senegal.

- The Bourse Régionale des Valeurs Mobilières (BRVM) is a key exchange for investors looking to tap into the West African market. The Daba platform provides an easy and efficient way to invest in stocks listed on BRVM, offering exposure to leading companies in the region’s dynamic sectors.

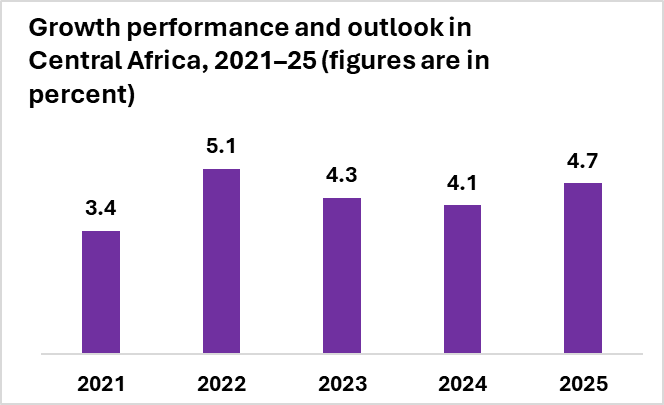

Central Africa: Steady Improvement

Growth Projections:

- Growth is expected to moderate slightly but improve strongly to 4.7% by 2025.

Investment Opportunities:

- The region’s growth is driven by favorable metal prices and increased investments in mining and infrastructure.

- Investors can explore opportunities in the Central African Stock Exchange (BVMAC) to gain exposure to these sectors.

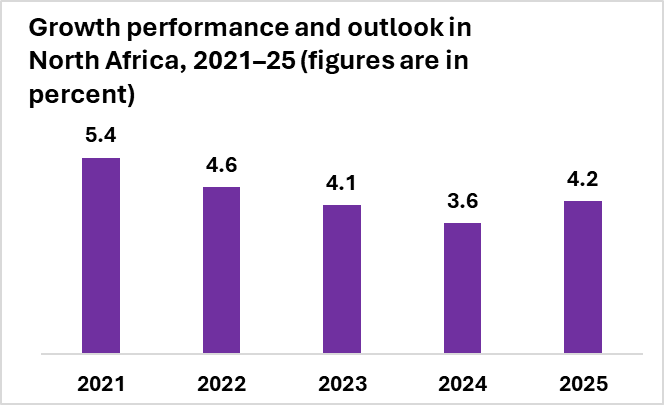

North Africa: Robust Potential

Growth Projections:

- Growth is projected to decline slightly from an estimated 4.1% in 2023 to 3.6% in 2024 but is expected to rebound to 4.2% in 2025.

Investment Opportunities:

- North Africa’s growth is supported by diversified economies, with strong performance in sectors such as tourism, manufacturing, and energy.

- The Casablanca Stock Exchange (CSE) and the Egyptian Exchange (EGX) offer robust investment opportunities in these key sectors.

- Tourism and hospitality sectors in countries like Morocco and Egypt present attractive prospects for investors.

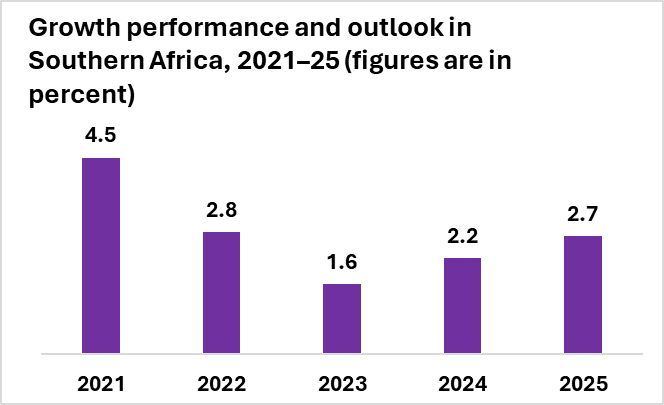

Southern Africa: Gradual Growth

Growth Projections:

- Growth is projected to increase gradually from an estimated 1.6% in 2023 to 2.2% in 2024 and firm up to 2.7% in 2025.

Investment Opportunities:

- Southern Africa’s growth is influenced by major economies like South Africa, which is experiencing a gradual recovery.

- Investors can explore opportunities in the Johannesburg Stock Exchange (JSE) for exposure to sectors such as mining, finance, and retail.

- South Africa’s diverse economy provides a range of investment options, from well-established industries to emerging sectors.

Inflation and Currency Dynamics

Inflation Trends:

- Average inflation in Africa rose to 17% in 2023, driven by higher food prices, liquidity overhangs, and currency depreciation.

- Inflation is expected to increase to 17.8% in 2024 before cooling down to 12.3% in 2025.

Currency Depreciation:

- Many African currencies depreciated in 2023 due to high global interest rates and economic uncertainties. Significant depreciation was seen in the Nigerian naira and Angolan kwanza, affecting overall economic stability.

Fiscal and External Balances

Fiscal Deficits:

- Fiscal deficits are expected to narrow from 5% of GDP in 2023 to 4.3% by 2025 as countries rein in spending and improve revenue mobilization.

Current Account Deficits:

- Average current account deficits are projected to widen slightly but are expected to stabilize with improved global trade and economic conditions.

Debt Levels:

- Public debt remains high, reflecting the burden of debt servicing on fiscal space. The median public debt ratio is expected to decline but remain above pre-pandemic levels.

External Financial Flows

Decline in External Financial Flows:

- Tightening global financial conditions led to a significant decline in external financial flows to Africa in 2022, affecting investment and development financing.

Challenges and Opportunities

Main Downside Risks:

- Persistent inflationary pressures, geopolitical tensions, higher commodity prices, regional conflicts, and climate shocks pose risks to economic recovery and growth.

Main Tailwinds:

- Positive trends in fiscal consolidation, structural transformation, and favorable global market conditions could enhance growth prospects.

Policy Recommendations

Short-Term Policies:

- Tailored monetary policy adjustments to achieve faster disinflation.

- Addressing exchange rate pressures and promoting local production to stabilize food prices.

- Implementing governance reforms and strengthening debt management to reduce the public debt burden.

Medium to Long-Term Policies:

- Scaling up domestic resource mobilization to accelerate structural transformation.

- Reforming global financial architecture to facilitate debt restructuring.

- Creating an enabling environment for external financial flows to support economic transformation.

Conclusion

The African Economic Outlook 2024 underscores the continent’s resilience and potential for sustainable growth despite global challenges.

Strategic investments in infrastructure, human capital, and structural reforms, coupled with effective policy implementation, can drive Africa’s transformation and enhance its economic prospects.

Investors looking to tap into Africa’s growth potential can explore opportunities in the continent’s fastest-growing regions, such as East and West Africa.

Platforms like the Daba app provide convenient access to investing in stocks listed on regional exchanges like BRVM, offering exposure to dynamic and rapidly growing markets.

Embrace the future of Africa’s economic growth and explore the myriad investment opportunities available in this resilient and promising continent. Get started here.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.