Investor Updates: 24 October 2022 - Egypt’s KarmSolar secures $2.4m funding from QNB ALAHLI

3 min Read October 24, 2022 at 10:33 AM UTC

Egypt’s KarmSolar secures $2.4m funding from QNB ALAHLI

Highlights

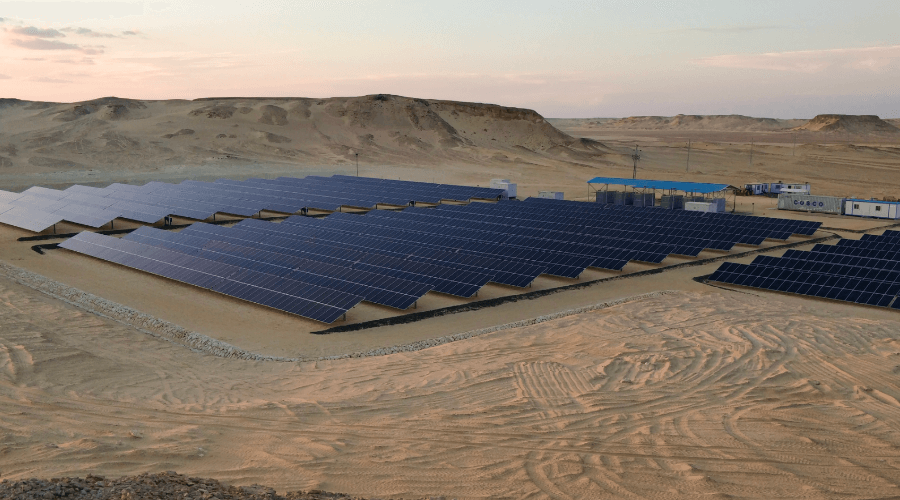

- Egypt-based cleantech KarmSolar has secured $2.4 million in funding from Qatar National Bank ALAHLI (QNB ALAHLI), as part of the company’s Phase 2 expansion of existing solar microgrid solution.

- Founded in 2011, KarmSolar provides several sectors in Egypt with renewable energy as part of its target to enlarge the private clean energy market.

- This new funding will boost KarmSolar’s plans to deploy battery solutions in Egypt and across the region on a larger scale.

Source: Wamda

Our Takeaway

Most businesses in Africa grapple with expensive electricity tariffs, frequent power outages, and load shedding. These issues limit production and increase operating and maintenance costs, thereby hindering growth. The decreasing costs of solar systems, relative to either grid or diesel generators, have helped solar solutions—provided by companies like KarmSolar—become economically viable alternatives for commercial and industrial use. Access to reliable power not only saves costs but also expands the number and variety of business and job opportunities available in an economy.

Flourish launches program to support African pre-seed startups

Highlights

- US-based venture capital firm Flourish Ventures has launched Madica, an Africa-focused program aimed at boosting access to capital and funding for pre-seed stage startups.

- The sector-agnostic Madica will offer funding, technical support, and mentorship to underrepresented founders across the continent.

- The program has set aside $6 million for investment in up to 30 African startups, each receiving up to $200,000 in exchange for equity, availing the much-needed funding. The initial investment phase will run for three years.

Source: TechCrunch

Our Takeaway

Access to funding and lack of support systems are some of the greatest challenges faced by startup founders in Africa. And while venture capital and founder support programs within the continent are growing, a lot still remains to be done to meet the financing, technology, and social capital needs of the especially marginalized groups. It’s why the launch of programs like Madica is important, especially as it plans to reach underserved markets in the continent, outside the well-established hubs of Egypt, Kenya, Nigeria, and South Africa.

Crypto giants buy massive units of Bitcoin through Binance, Coinbase

Highlights

- Two major Bitcoin entities are reportedly stockpiling Bitcoin (BTC) at the moment despite uncertain market conditions. It’s important to note that the benchmark digital currency has decreased by almost 60% this year.

- This is according to Ki Young Ju, the CEO of analytics company Crypto Quant, who has 308,400 followers on Twitter, wealthy investors are aggressively stockpiling bitcoin through renowned digital asset exchange Binance.

- Ki Young Ju further noted that the volume of spot trading in bitcoin has grown significantly over the last six months on all exchanges, indicating that there is enough demand to resist the intense selling pressure.

Source: Nairametrics

Our Takeaway

Bitcoin, the leading cryptocurrency, has seen a significant decline from its record high this year amid turmoil in financial markets across the world. As the central banks globally continue to aggressively tighten monetary policy to tackle rising inflation, investors have fled from riskier asset classes like cryptocurrencies, leading to sell-offs in large quantities this year. However, the volume of spot trading in bitcoin has grown significantly over the last six months on all exchanges, per Crypto Quant, indicating that there might be enough demand to resist the intense selling pressure.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.