Investors update: Private equity AIIM invests $90m in new pan-African data center

3 min Read August 23, 2023 at 1:27 PM UTC

Private equity AIIM invests $90m in new pan-African data center

Highlights

- African Infrastructure Investment Managers (AIIM) is working with N+ONE Data Centers, an African data center owner and operator, to develop a new data center and cloud services platform with a short-term target capacity of 40 MW.

- AIIM will be contributing an initial $90 million of growth equity through its latest pan-African infrastructure fund, African Infrastructure Investment Fund 4.

- The platform will focus on the development of hyper-scale and wholesale carrier-neutral facilities to provide solutions to enterprise, government, and hyper-scale customers across the continent.

Source: ABC

Our Takeaway

There is currently more than 300MW of installed IT load in Africa, the majority of which is in South Africa. Exponential growth in data generation and consumption in combination with an increased focus on data sovereignty will result in the onshoring of data onto the continent. With data center demand expected to grow to over 1GW by 2030, significant investment is needed to support the growth potential of the continent’s digital economy. Investors have been actively seeking to capture this opportunity—more than $5 billion is expected to be invested in African data centers by 2025.

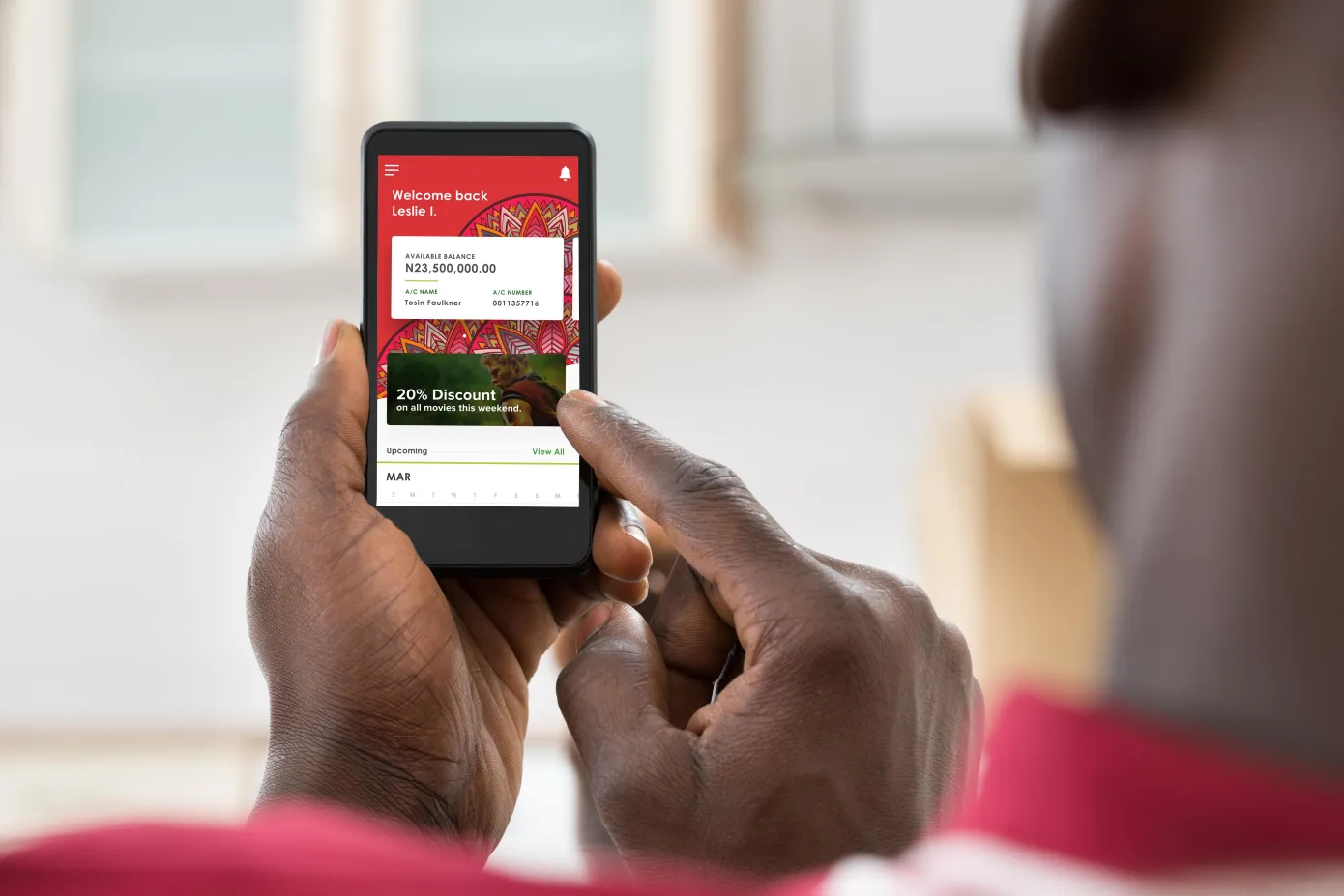

Moniepoint nears Kenya expansion after regulatory clearance

Highlights

- The competition regulator in Kenya has given Moniepoint Inc. the green light to acquire Kopo Kopo, a Kenya-based company offering payment services and credit to businesses.

- Following the approval by the Competition Authority of Kenya (CA), Moniepoint (formerly TeamApt) will expand its services to Kenya continuing its growth plans across the continent.

- Moniepoint Inc., which runs one of the largest business payments and banking platforms in Nigeria, is keen on expanding to new markets with a mature banking or payments infrastructure.

Source: TechCrunch

Our Takeaway

The informal business sector in Africa offers a lot of promise for startups looking to digitize B2B payment flows. The cash-dominated space is rife with late payments and stunts the growth of commerce. Most merchants operate offline in an estimated $800 billion informal trade economy comprising more than 56 million micro, small, and medium-sized businesses. A survey covering 3,500 companies across 6 countries found that 23% of small businesses experience delayed payments. This explains why merchant acquisition is proving to be Africa’s “new” scramble for digital services.

South Africa inflation at two-year low signals rates respite

Highlights

- South Africa’s inflation slowed to the lowest level in two years last month, beating expectations and providing room for the central bank to continue keeping interest rates on hold.

- The headline consumer-price index rose 4.7% in July from a year earlier, compared with 5.4% in June, according to data from Statistics South Africa. The median of 15 economists’ estimates in a Bloomberg survey was 4.9%.

- The SARB’s Monetary Policy Committee (MPC) has stressed that it wants to see inflation sustainably around the midpoint of its target range, around 4.5% before it contemplates rate cuts.

Source: Bloomberg

Our Takeaway

We’ve covered inflation movements across different African economies more frequently in the last few weeks. But what is inflation and why does it matter? Put simply, inflation is the rate at which prices for goods and services increase across an economy. The rate at which prices change can have ramifications across the economy, affecting businesses and consumers alike. For instance, when high levels of inflation occur, the value of one’s money (also known as purchasing power) erodes, as consumers are no longer able to buy as many products with the same amount of money, ultimately affecting businesses that produce and sell to them.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.