Binance CEO sees Bitcoin topping $80k as ETF inflows fan rally

TLDR

- Bitcoin set to surpass $80,000 fueled by institutional interest in crypto-backed ETFs

- Richard Teng optimistic about Bitcoin's future growth trajectory despite potential volatility

- Anticipation for Bitcoin to exceed $80,000 due to reduced supply and sustained demand

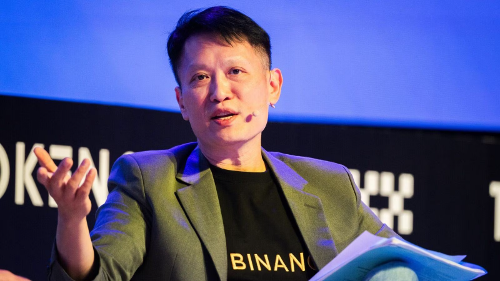

Bitcoin is poised to extend its remarkable surge and surpass the $80,000 mark, fueled by growing interest from institutional investors in crypto-backed exchange-traded funds (ETFs), according to Richard Teng, CEO of Binance.

Teng made these remarks during an event in Bangkok, highlighting the significant inflows of new funds into the cryptocurrency market following the launch of Bitcoin ETFs in the US earlier this year. He expressed optimism about the future trajectory of Bitcoin, stating that "we're just getting started."

Initially predicting Bitcoin to reach $80,000 by the end of the year, Teng now anticipates it to exceed that milestone due to a combination of reduced supply and sustained demand. However, he cautioned that the journey might not be without volatility, emphasizing that market fluctuations are a natural part of the process.

Key Takeaways

Bitcoin, the leading cryptocurrency globally, has witnessed a remarkable 56% surge since the beginning of the year, soaring to a record high of nearly $73,798 last week. While this rally has elicited concerns of a potential bubble from some investors, prompting periods of volatility and selloffs in recent sessions, there has been a continuous influx of funds into US spot Bitcoin ETFs since their approval in January. This trend is expected to persist, with further increases anticipated in allocations from endowments and family offices into Bitcoin ETFs soon. Such developments underscore the growing institutional acceptance and adoption of Bitcoin as a legitimate asset class.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.