BRVM-Listed Sicable Annual Profit Declines on Higher Taxes

TLDR

- Société Ivoirienne de Câbles (CABC) reported a solid performance for 2024, with a 7% increase in overall revenue to 19.125 million FCFA (around $31.8 million)

- The company saw strong sales in aluminum cables, up 19%, but faced challenges in export markets, where sales dropped by 35%

- Net income dropped to 1.225 million FCFA ($2.03 million), down from 1.431 million FCFA ($2.38 million) in 2023

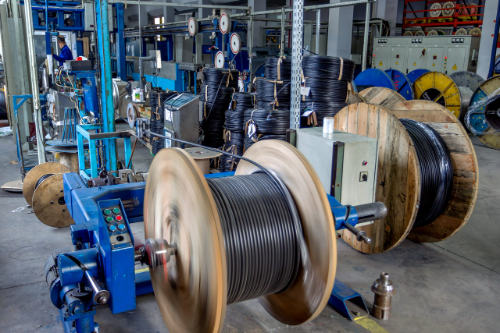

Société Ivoirienne de Câbles (CABC) reported a solid performance for 2024, with a 7% increase in overall revenue to 19.125 million FCFA (around $31.8 million). The company saw strong sales in aluminum cables, up 19%, but faced challenges in export markets, where sales dropped by 35%.

Operating profit grew to 1.785 million FCFA ($2.96 million), a slight increase from the previous year. However, its net income dropped to 1.225 million FCFA ($2.03 million), down from 1.431 million FCFA ($2.38 million) in 2023. The decrease was attributed to higher taxes and a reduction in provisions for bad debts.

Sicable also made notable investments, with capital expenditures rising to 159 million FCFA ($264,000), driven by new production and transport equipment. The company’s working capital showed a slight decline, indicating tighter liquidity management amid external pressures. Looking ahead to 2025, Sicable plans to focus on securing raw material supplies and expanding into new markets, aiming for 20% of its margins to come from these areas. The stock (CABC) is up 19% in the past week.

Daba is Africa's leading investment platform for private and public markets. Download here

Key Takeaways

Sicable’s 2024 results reflect the growing challenges in the Ivorian market, such as rising costs and competition, but the company’s performance is improving. Its efforts in innovation and expanding into new markets, including renewable energy and exports, are critical to future growth. The decrease in net income, despite strong revenue growth, highlights the impact of external factors like taxes and currency fluctuations. The company’s strategic focus on strengthening its supply chain and improving operational efficiency will be key to maintaining profitability in 2025 and beyond.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.