Ghana Inflation Falls Below 10% For First Time Since 2021

TLDR

- Ghana’s inflation slowed to 9.4% in September, marking its ninth consecutive monthly decline and the first single-digit reading since August 2021

- The rate now sits within the Bank of Ghana’s medium-term target band of 8% ±2%, reaching the end-2025 target three months ahead of schedule

- Food inflation decreased to 11% from 14.8%, while the rate of imported goods slowed to 7.4% and services to 4.8%

Ghana’s inflation slowed to 9.4% in September, marking its ninth consecutive monthly decline and the first single-digit reading since August 2021, according to the Ghana Statistical Service. The rate now sits within the Bank of Ghana’s medium-term target band of 8% ±2%, reaching the end-2025 target three months ahead of schedule.

Government Statistician Alhassan Iddrisu said the data confirms a disinflation process that began late last year after inflation peaked near 24% in December 2024. The drop reflects base effects, easing food prices, and a more stable cedi.

Food inflation decreased to 11% from 14.8%, while the rate of imported goods slowed to 7.4% and services to 4.8%. Local goods inflation remained high at 10.1%, and regional disparities persisted — from 20.1% in the Northeast to 1.2% in Bono East.

In response, the central bank cut its key policy rate by 350 basis points to 21.5%.

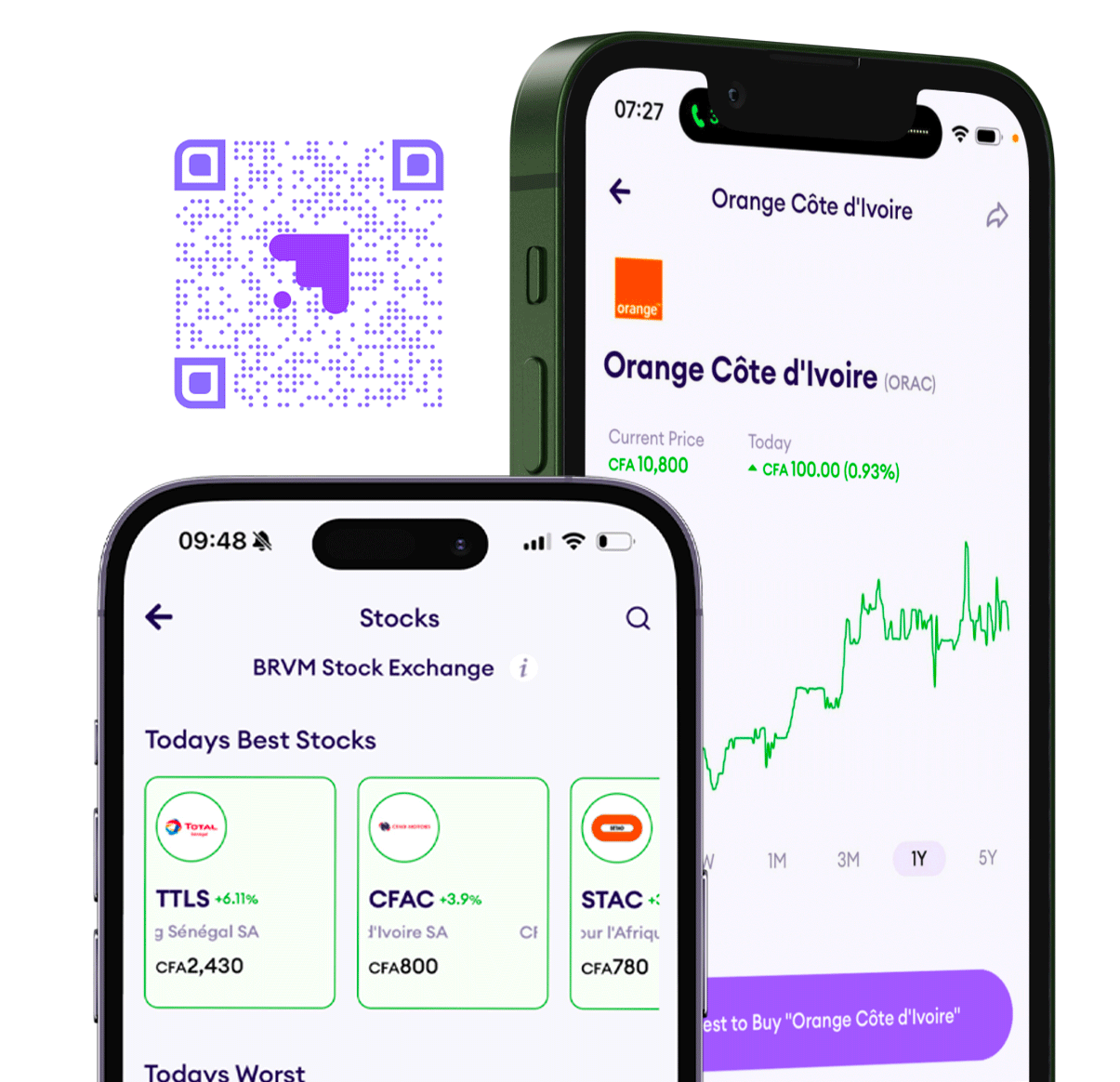

Daba is Africa's leading investment platform for private and public markets. Download here

Key Takeaways

Ghana’s return to single-digit inflation marks a turning point for one of West Africa’s most inflation-hit economies, offering relief after two years of high prices and currency volatility. The decline enhances the Bank of Ghana’s credibility and supports the government's efforts to stabilize macroeconomic conditions under the IMF-supported program. However, vulnerabilities remain: a renewed cedi depreciation, rising fuel costs, and potential utility tariff hikes could reverse gains. The central bank’s sharp rate cut — its largest in years — signals confidence in sustained disinflation but also aims to stimulate credit growth after prolonged tightening. For households, price relief is uneven, with food and import costs easing but energy and basic goods still elevated. The challenge now is to preserve stability while reigniting growth and maintaining fiscal discipline ahead of the 2026 elections.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.