Kenya raises $443m in oversubscribed infrastructure bond

Kenya's government successfully raised 67.06 billion shillings ($443 million) through an oversubscribed infrastructure bond. Originally targeted at raising 50 billion shillings for developmental projects, the six-and-a-half-year amortized bond garnered substantial interest, with bids totaling 88.89 billion shillings.

The Central Bank of Kenya confirmed the acceptance of 67.06 billion shillings, with an associated interest rate of 17.93%. The bond, available for subscription from October 20 to November 8, is set to mature in 2030. Importantly, the interest earned from this bond will enjoy tax-free status, aligning with the provisions outlined in the East African country's Income Tax Act for infrastructure securities.

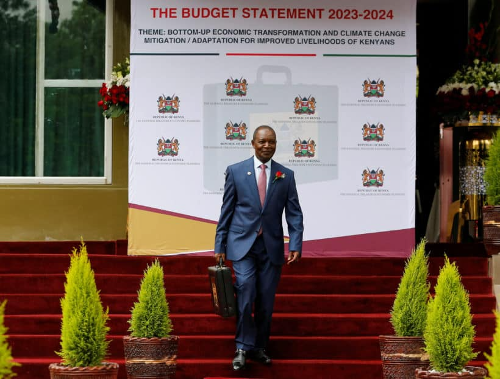

This bond issuance forms a part of the government's strategy to address a 4.4% budget deficit for the fiscal year 2023/24, spanning from July to the end of June. Njuguna Ndung'u, Kenya's finance minister, presented the budget amid economic challenges, including a sluggish economy, rising inflation, and a slower-than-expected pace of tax collection, contributing to the observed deficit.

Key Takeaways

Africa's rapid urbanization is creating investment opportunities as megacities grow. By 2030, these cities are projected to have a population of 145 million. But there is a lack of adequate infrastructure to cater to this growth. Despite ongoing efforts to enhance regional transport infrastructure connectivity, Africa still grapples with infrastructure deficiencies. Insufficient road, rail, and port facilities contribute an additional 30% to 40% to the costs of goods traded among African nations. These challenges not only hinder private sector expansion but also impede the flow of foreign direct investments, as estimated by the World Bank. Governments have shown a keen awareness of the transformative potential of infrastructure improvements on economic growth. In the past decade, investments in infrastructure have been responsible for propelling over half of Africa's recent economic growth.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.