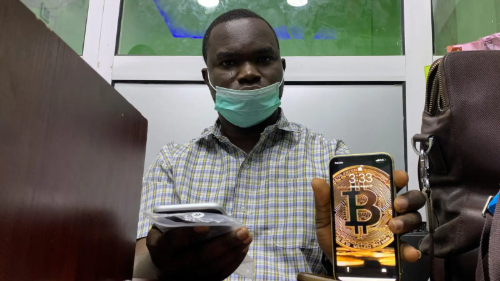

Nigeria Legalizes Crypto with Securities Law But Questions Remain

TLDR

- On March 25, 2025, Nigeria formalized the legal status of cryptocurrencies by signing the Investments and Securities Act (ISA 2025) into law

- President Bola Tinubu’s approval of the 226-page Act marks the clearest regulatory stance Nigeria has taken on digital assets, officially recognizing them as securities

- The move follows years of regulatory ambiguity, including the Central Bank’s 2021 ban on crypto-related bank transactions and the SEC’s interim sandbox

On March 25, 2025, Nigeria formalized the legal status of cryptocurrencies by signing the Investments and Securities Act (ISA 2025) into law. President Bola Tinubu’s approval of the 226-page Act marks the clearest regulatory stance Nigeria has taken on digital assets, officially recognizing them as securities and placing them under the supervision of the Securities and Exchange Commission (SEC).

Under the new law, the SEC now has sweeping powers over digital asset activities—including issuance, trading, promotion, and compliance enforcement. The regulator can audit exchanges, suspend firms, penalize violations, and enforce rules on token offerings. The law also defines digital assets broadly to include cryptocurrencies, stablecoins, tokenized assets, and any blockchain-issued instruments with value or trading utility.

The move follows years of regulatory ambiguity, including the Central Bank’s 2021 ban on crypto-related bank transactions and the SEC’s interim sandbox launched in 2024. Now, crypto is formally part of Nigeria’s capital markets framework.

Daba is Africa's leading investment platform for private and public markets. Download here

Key Takeaways

The ISA 2025 is a milestone for Nigeria’s fast-evolving crypto space, but its impact will depend on how it’s implemented. The law opens up paths for greater institutional investment and regulatory trust—important developments in a market still recovering from 2024’s Binance regulatory conflict and the global crypto downturn. However, for Web3 startups, the challenges are clear. The law imposes compliance burdens that risk sidelining smaller players. Costly licensing, audits, and onboarding tools like Chainalysis, now mandated by the SEC, raise the bar for participation. With ₦500 million ($311,000) capital requirements for digital exchanges and ₦2 million ($1,245) ARIP application fees, startups may face barriers too steep to overcome. The new law also creates uncertainty for startups dependent on international blockchain infrastructure. Platforms using networks like Stellar, Solana, or Ethereum now face regulatory risk if their underlying tokens are classified as securities. Local developers relying on APIs, stablecoin integrations, and tooling from global platforms could see access or pricing change if foreign players opt out of Nigerian compliance.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.