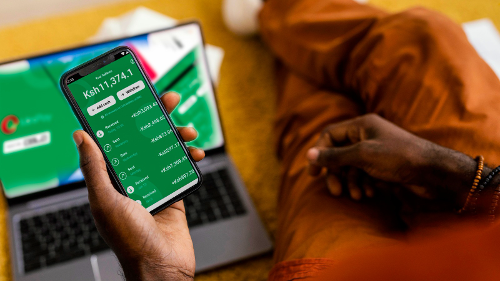

Opera’s MiniPay surpasses 1m users as DeFi adoption surges in Africa

TLDR

- Opera MiniPay rapidly gains over one million users in Kenya, Nigeria, and Ghana within five months of launch, showcasing the rise of DeFi tools in Africa.

- MiniPay's decentralized wallet, focused on dollar stablecoins like cUSD on the Celo blockchain, offers stability and reliability through a currency basket peg.

- Utilizing mobile phone numbers as identifiers, MiniPay simplifies transactions and expands financial accessibility for African users.

The rapid uptake of Opera MiniPay, which has garnered over one million users across Kenya, Nigeria, and Ghana within just five months of its launch, underscores the growing popularity of decentralized finance (DeFi) tools across the African continent.

Opera MiniPay serves as a self-custodial wallet designed for dollar stablecoins, offering cUSD, a stablecoin built on the Celo blockchain. This stablecoin is positioned as "decentralized," meaning its value is pegged to a basket of currencies, enhancing its stability and reliability.

According to Charles Hamel, MiniPay's product director, the platform simplifies and lowers the cost of acquiring, sending, and receiving Mento cUSD stablecoins, leveraging mobile phone numbers as identifiers. This approach facilitates greater accessibility and inclusivity, particularly for individuals in Africa seeking convenient and affordable financial solutions.

Key Takeaways

The significant currency volatility observed across Africa has had a profound impact on some of the continent's most robust currencies, including the Nigerian Naira and the Kenyan Shilling. Both currencies have experienced substantial devaluation, with Bloomberg data identifying them among the top 10 most devalued currencies globally in 2023. The Naira, in particular, ranked as the third most devalued currency worldwide, suffering a staggering 55% loss of value against the US dollar. Similarly, the Kenya Shilling depreciated by over 20% relative to the greenback during the same period. Despite the challenges posed by currency devaluation, the burgeoning DeFi sector has garnered attention from investors. Canza Finance, a Nigerian Web3 Neobank specializing in cross-border payments for African startups, raised $2.3 million in January 2024 to expand its African DeFi platform, Baki. This investment underscores growing investor confidence in DeFi-backed startups in Africa, which are leveraging innovative technologies to address the complexities of cross-border transactions and mitigate the impact of currency volatility on financial operations.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.