Visa Partners Yellow Card to Expand Stablecoin Payments Across Africa

TLDR

- Visa has partnered with Yellow Card to pilot stablecoin-powered cross-border payments across CEMEA

- The collaboration will test integration with Visa Direct, enabling businesses to send stablecoin-backed transfers directly to users’ bank or card-linked accounts

- Sub-Saharan Africa has witnessed consistent monthly stablecoin remittances exceeding $500 billion between 2022 and 2024

Visa has partnered with Yellow Card, a leading pan-African stablecoin infrastructure company, to pilot stablecoin-powered cross-border payments across Central and Eastern Europe, the Middle East, and Africa (CEMEA). The collaboration will test integration with Visa Direct, enabling businesses to send stablecoin-backed transfers directly to users’ bank or card-linked accounts.

The partnership allows businesses to hold U.S. dollars in stablecoins and settle payments across borders more efficiently, reducing cost, increasing speed, and making transfers available 24/7. The initiative is part of Visa’s broader strategy to modernize money movement infrastructure using digital assets.

Sub-Saharan Africa is expected to be a key beneficiary. The region has witnessed consistent monthly stablecoin remittances exceeding $500 billion between 2022 and 2024. In Ethiopia, stablecoin-powered low-value transfers rose 180% year-on-year, while Nigeria ranks among the top markets for USDT usage on exchanges.

“Traditional payment companies now ask not if they need a stablecoin strategy, but how fast they can deploy it,” said Chris Maurice, CEO of Yellow Card. Visa’s Godfrey Sullivan added that institutions moving money in 2025 “will need a stablecoin strategy,” and Visa aims to provide the tools to make that happen.

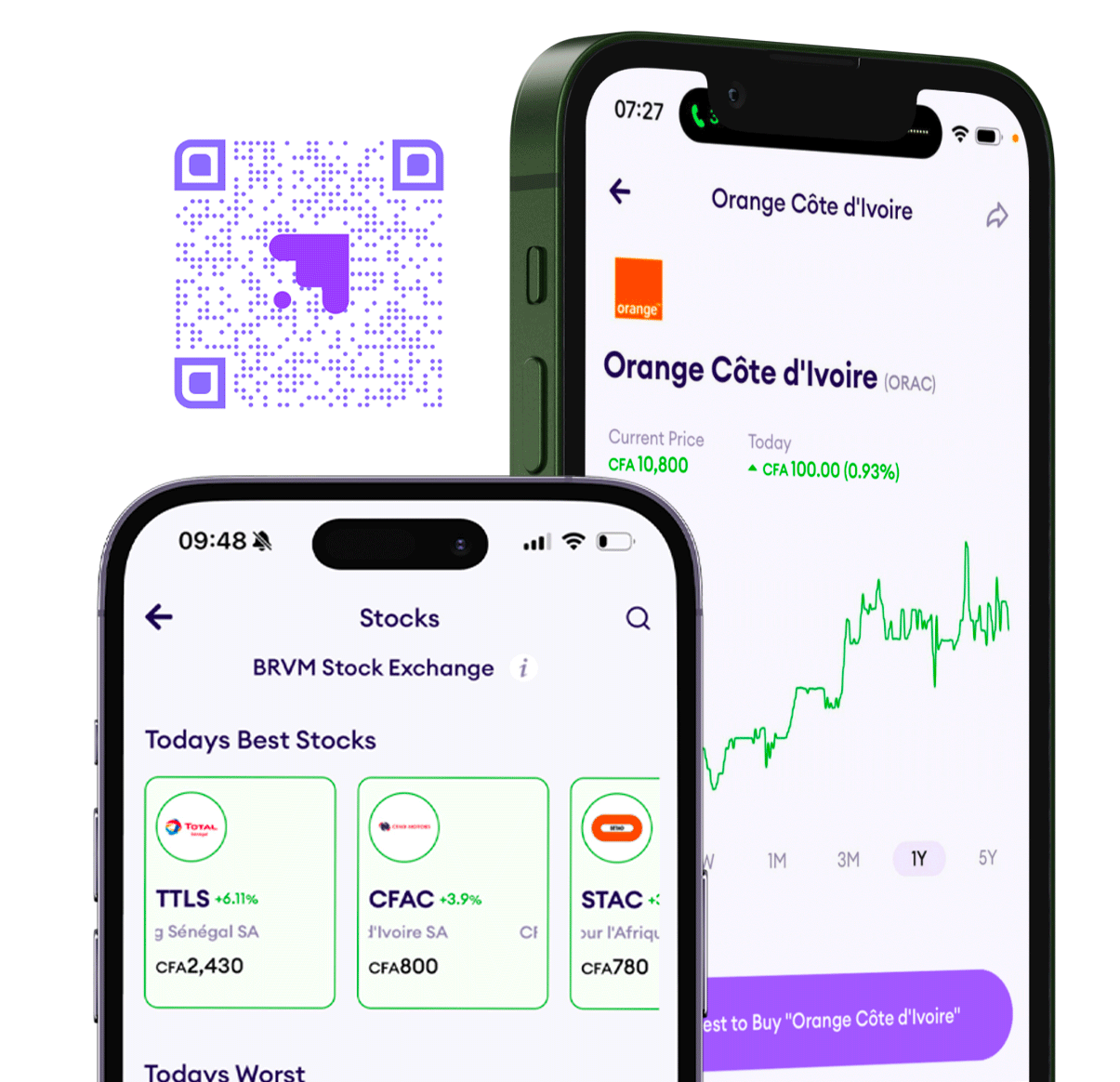

Daba is Africa's leading investment platform for private and public markets. Download here

Key Takeaways

Visa’s partnership with Yellow Card underscores the rapid institutionalization of stablecoins. Stablecoins, especially USD-backed assets like USDC and USDT, are increasingly used to bypass FX volatility, settle B2B payments, and enable low-cost remittances in emerging markets. In Africa, where currency instability and high transfer costs hinder trade and remittances, dollar-stablecoins offer a practical alternative. Globally, stablecoin payments hit $4.1 trillion in the past month, surpassing Visa’s own quarterly volumes. Companies like Shopify, Stripe, and Coinbase are already embedding stablecoins into mainstream commerce. In Africa, local innovations like Nigeria’s cNGN are accelerating the continent’s digital currency experimentation.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.