Francophone West African Banks Face Liquidity Strain Despite Profits

TLDR

- West Africa’s banking sector remains profitable but is grappling with a growing shortage of liquidity, raising concerns about credit availability and long-term growth

- The balance sheet of the 160 licensed banks in the West African Economic and Monetary Union (WAEMU) expanded 9.3% between 2023 and 2024

- Since February 2023, when the BCEAO reintroduced variable-rate auctions, average three-month interbank rates have climbed from 4.16% to 6.08%.

West Africa’s banking sector remains profitable but is grappling with a growing shortage of liquidity, raising concerns about credit availability and long-term growth.

The balance sheet of the 160 licensed banks in the West African Economic and Monetary Union (WAEMU) expanded 9.3% between 2023 and 2024, while net income rose 11.7%, according to the region’s Banking Commission. Non-performing loans fell slightly, inflation is projected below 2.5% this year, and GDP growth is forecast at 6.8% in 2025.

But behind the positive numbers, liquidity is tightening. Since February 2023, when the BCEAO reintroduced variable-rate auctions, average three-month interbank rates have climbed from 4.16% to 6.08%. Banks’ refinancing requests surged from CFAF 2.6 trillion to CFAF 8.2 trillion. Institutions are also hoarding reserves, holding more than three times the minimum required.

Analysts warn this is restricting private-sector credit, with lending growth of just 6–7% annually, barely in line with economic expansion.

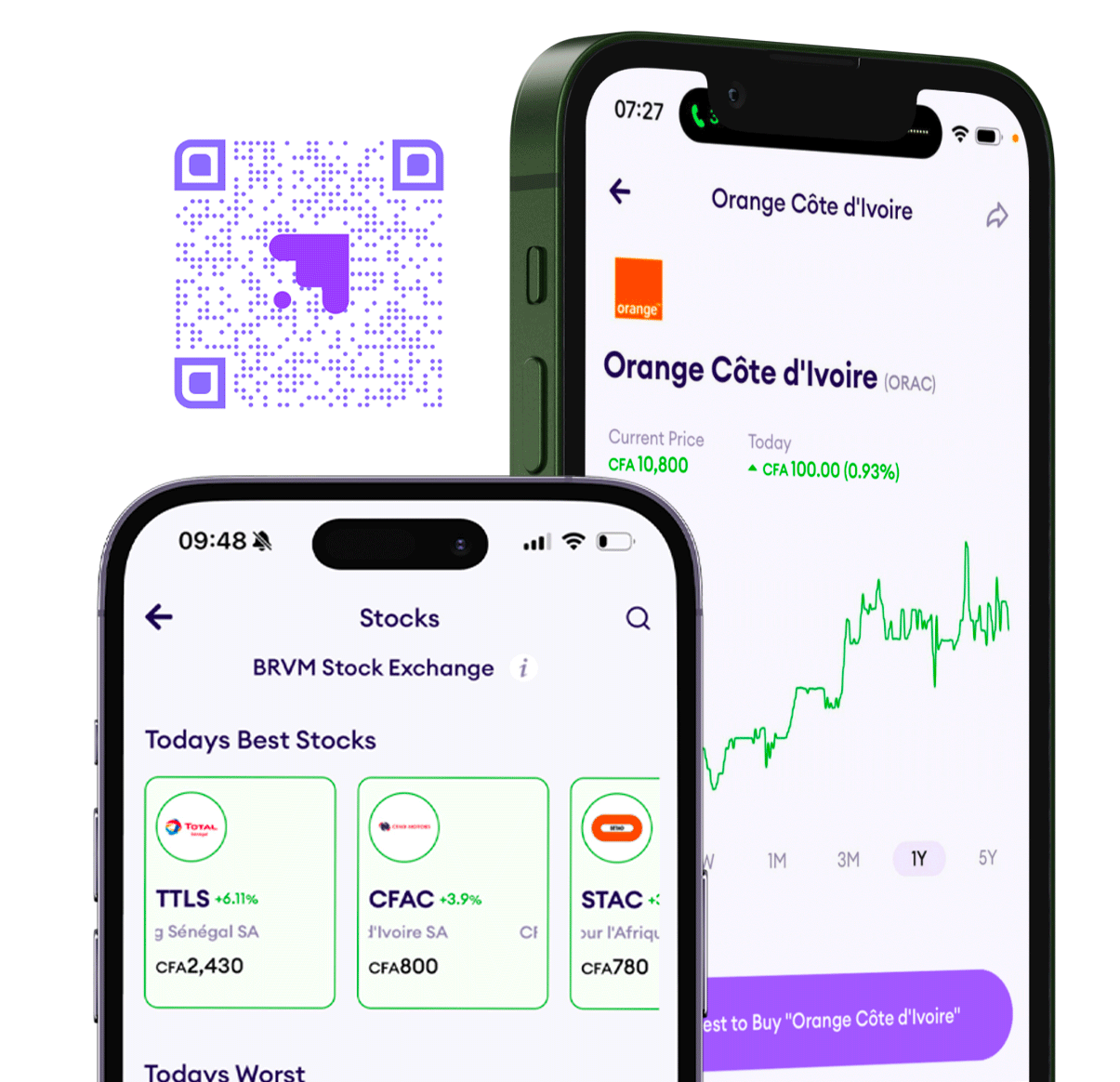

Daba is Africa's leading investment platform for private and public markets. Download here

Key Takeaways

The liquidity squeeze stems from several structural and regulatory shifts. Banks are stockpiling cash to meet higher capital requirements, shield themselves against regional uncertainty, and position for acquisitions of exiting international lenders’ subsidiaries. They are also lending more to governments, seen as risk-free borrowers, crowding out private businesses. Fitch Solutions notes Senegal as a case in point: government loans rose from 22% of banks’ portfolios in 2015 to 34% in early 2025, while private-sector lending fell to 60%. This dynamic risks slowing growth, particularly for SMEs. The BCEAO, while keeping policy rates low, has effectively tightened conditions through its refinancing mechanisms. Economists warn of a “latent” banking crisis if liquidity strains persist, with potential fragmentation across WAEMU markets as stronger economies like Côte d’Ivoire access funds more cheaply than weaker states such as Niger. For now, regulators emphasize solidarity, but rising sovereign exposure could test the resilience of the monetary union.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.